Tell me if any of this resonates with you...

QuickBooks and spreadsheet tools like Excel are often suitable for managing financial tasks when your business is in its early stages. However, as your business expands, the limitations of these tools can become more apparent, leading to increased operational challenges and inefficiencies.

As your business scales up, it's important to recognize the signs that you might be outgrowing these initial solutions.

Here are some key indicators that it might be time to consider more advanced

financial management systems:

Overreliance on

Spreadsheets

Relying heavily on spreadsheets can lead to a deep sense of frustration and vulnerability as your business grows.

Initially simple and convenient, these tools quickly become overwhelming and error-prone, trapping you in a chaotic tangle of data that stifles your company's potential.

This overdependence not only creates a stressful environment but also exposes your business to significant risks, blocking the path to innovation and growth

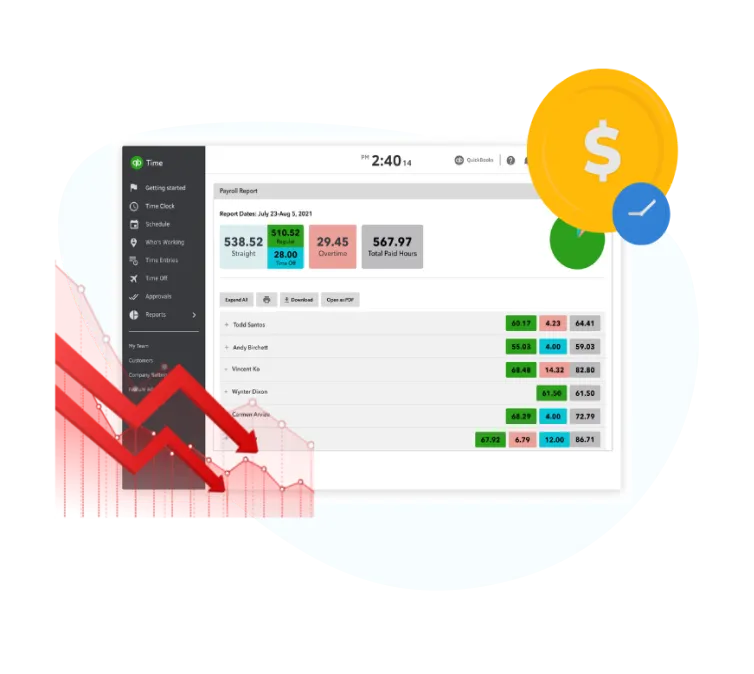

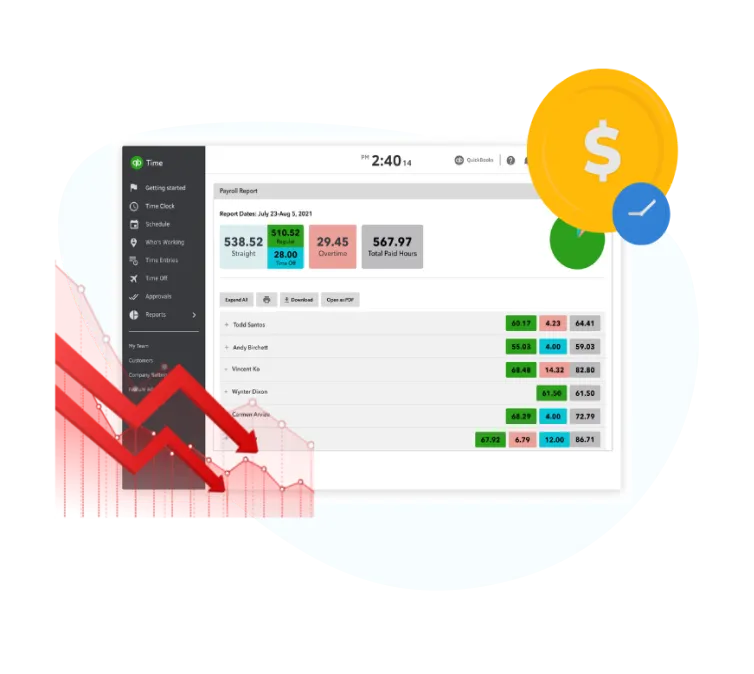

Scalability

Limitations

Growth often brings complexity in business operations, requiring more sophisticated accounting features. For example, larger businesses might need better tools for multi-currency transactions, advanced inventory management features, or detailed financial forecasting that QuickBooks doesn't offer natively or might offer only in more expensive editions.

As businesses grow, the number of transactions typically increases. This can include everything from sales, purchases, inventory adjustments, to payroll entries. QuickBooks might experience performance slowdowns or become less efficient with handling larger datasets, which can affect daily operations and reporting accuracy.

Reporting

Limitations

QuickBooks comes equipped with a suite of built-in reporting and dashboard features designed to help businesses manage their financial data effectively.

However the saas industry has some unique reporting requirements and many business owners find themselves relying on external spreadsheet software like Microsoft Excel or Google Sheets.

This reliance involves exporting data from QuickBooks and then manipulating it in spreadsheets to create custom reports. This process not only increases the workload but also introduces a greater risk of errors due to manual data entry and manipulation.

Revenue Recognition (ASC 606) Challenges

Complexity in Recognizing Revenue: QuickBooks does not have built-in functionality to handle the complex revenue recognition requirements of ASC 606, forcing SaaS companies to rely on manual processes that are prone to errors and time-consuming.

Inaccurate Financial Reporting: Without automated revenue recognition, SaaS companies face difficulties in ensuring accurate and consistent financial reporting, which can lead to discrepancies and misstatements in their financial statements.

Compliance Risks: The lack of robust revenue recognition tools increases the risk of non-compliance with ASC 606 regulations, potentially leading to regulatory scrutiny, fines, and damaged reputation.

Billing Challenges

Complex Billing Requirements: SaaS companies often have complex billing requirements, including recurring billing, usage-based billing, and multi-tier pricing, which QuickBooks is not equipped to handle efficiently.

Manual Billing Processes: The limitations of QuickBooks force SaaS companies to rely on manual billing processes, increasing the risk of errors and inefficiencies that can delay revenue collection and impact cash flow.

Inconsistent Billing and Cash Flow Issues:Inadequate billing capabilities can lead to inconsistent billing cycles and cash flow issues, making it difficult for SaaS companies to maintain financial stability and forecast future revenue accurately.

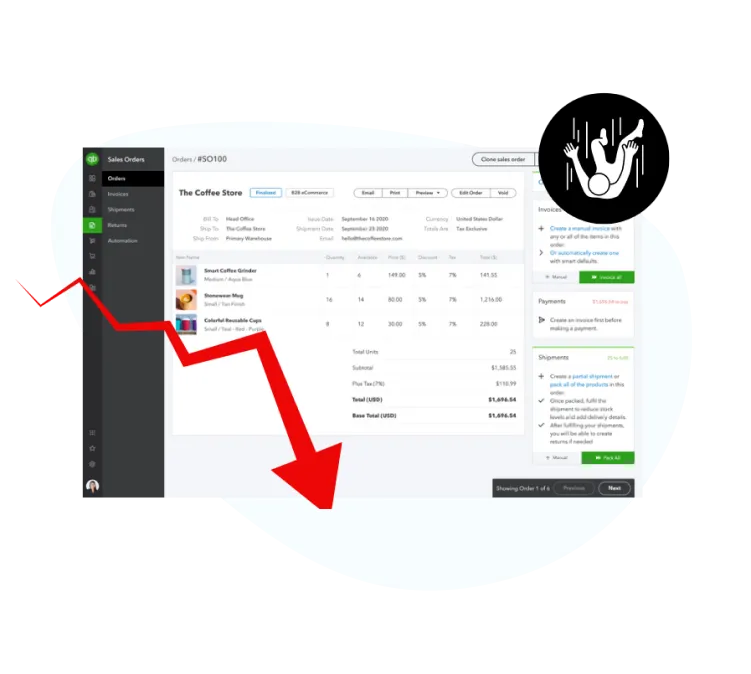

Disconnected Operations and Financials

Disconnected systems lead to inconsistencies in data across different departments and operations. This makes it difficult to generate accurate and consolidated financial reports, hindering the ability to get a clear picture of the company's overall financial health and performance.

When systems are not seamlessly connected, it can lead to a disjointed workflow, causing delays, errors in order processing, and a frustrating customer experience.

This disconnection can hinder a company’s ability to scale efficiently and respond quickly to market demands, ultimately impacting revenue and growth opportunities.

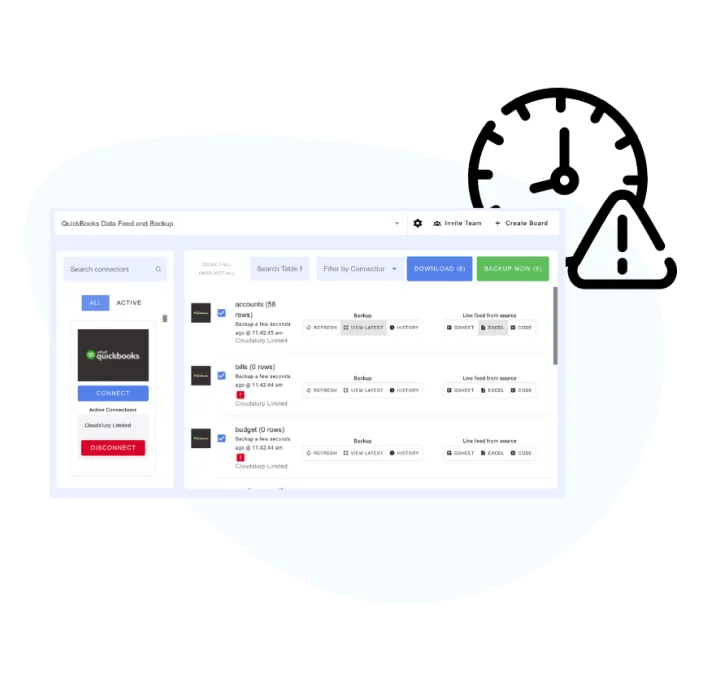

Lack of Realtime

Financials

Operating without real-time financials can leave businesses navigating in the dark, struggling to make informed decisions swiftly.

This delay in financial reporting can lead to missed opportunities and reactive instead of proactive management, stalling growth and innovation.

The inability to access up-to-date financial data creates a stressful environment of uncertainty, making it challenging to respond to market changes effectively.

Contract Management Challenges

Manual Tracking and Management: QuickBooks lacks dedicated features for contract management, resulting in manual tracking of contract terms, renewal dates, and amendments, which is inefficient and error-prone.

Missed Renewals and Revenue Leakage: Without automated alerts and tracking, SaaS companies may miss contract renewal dates, leading to potential revenue leakage and lost business opportunities.

Difficulty in Maintaining Accurate Records: Managing contracts manually in QuickBooks can lead to difficulties in maintaining accurate and up-to-date customer records, complicating customer relationship management and financial reporting.

Upsells and Cross-Sells Challenges

Limited Tracking of Sales Opportunities: QuickBooks does not provide robust tools to track and manage upsell and cross-sell opportunities, making it difficult for SaaS companies to identify potential additional revenue streams within their existing customer base.

Inefficient Sales Processes: The lack of integrated upsell and cross-sell management features leads to inefficient sales processes, as sales teams must rely on manual methods to identify and pursue these opportunities.

Reduced Customer Lifetime Value: Without effective tracking and management of upsell and cross-sell opportunities, SaaS companies may miss out on maximizing customer lifetime value and increasing overall revenue.

If you said “YES” to any of the above, then you’re in the right place!

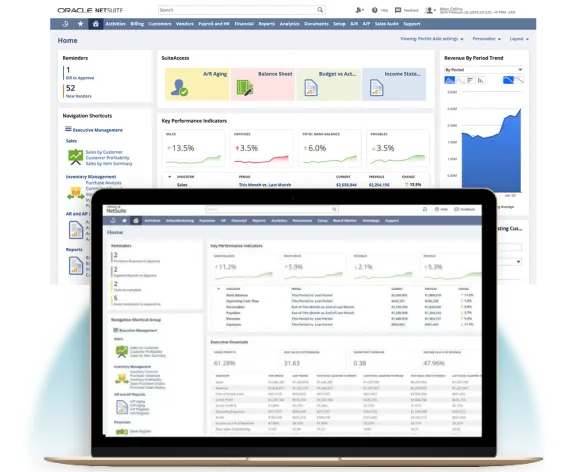

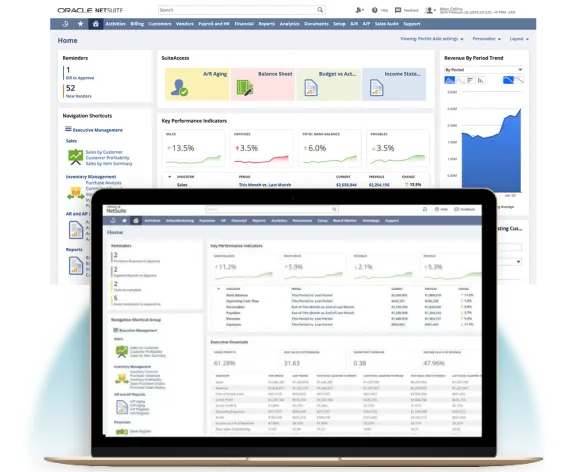

Replace QuickBooks and Spreadsheets with NetSuite

Elevate your saas business with NetSuite, the all-in-one cloud ERP solution tailored for your industry's unique needs. Our platform brings together every aspect of your business—from supply chain logistics to customer engagement—into one seamless system.

Gain real-time visibility and unparalleled control, enabling more efficient operations, reduced costs, and better decision-making. With advanced analytics at your fingertips, stay on top of market trends and consumer behaviors to outpace the competition. Whether you're scaling up or optimizing existing processes, NetSuite grows with you. Revolutionize your business with NetSuite and lead the way in innovation.

Single System

of Truth

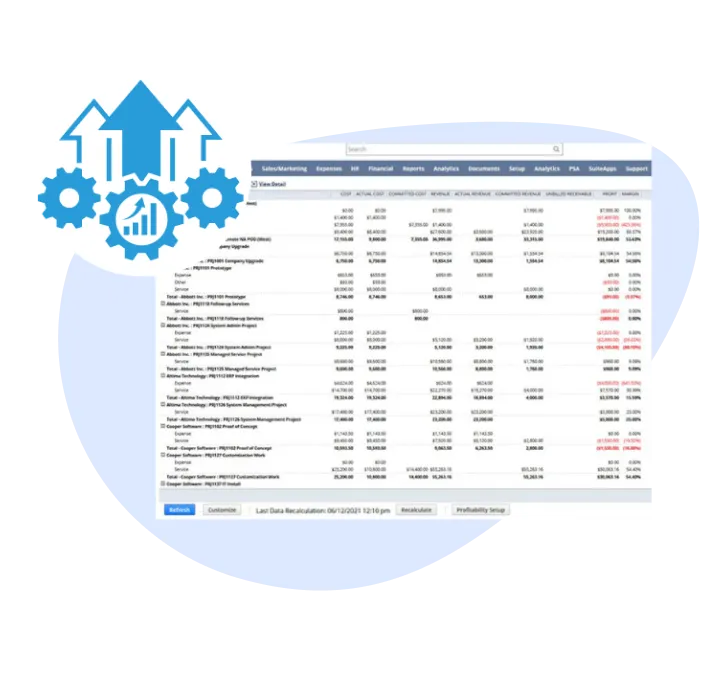

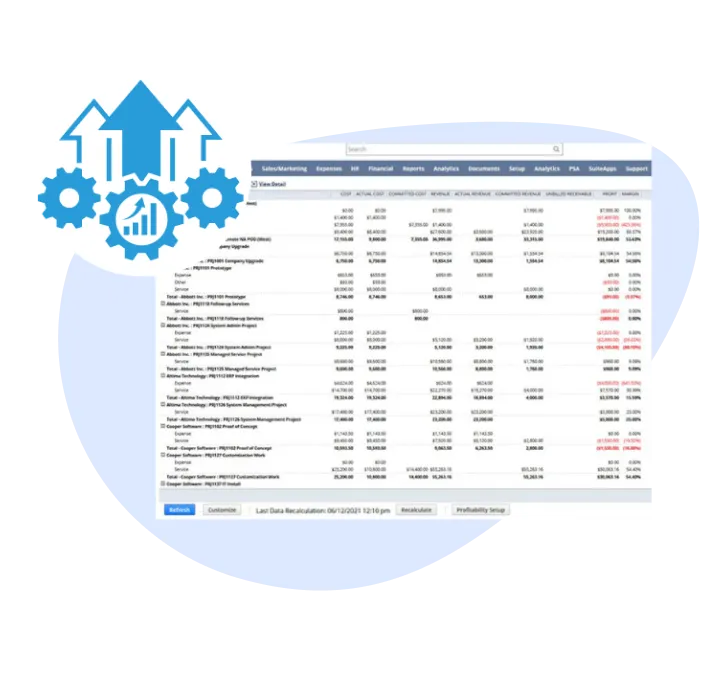

NetSuite provides a single system of truth, centralizing data across all departments to enhance transparency, streamline operations, and support informed decision-making.

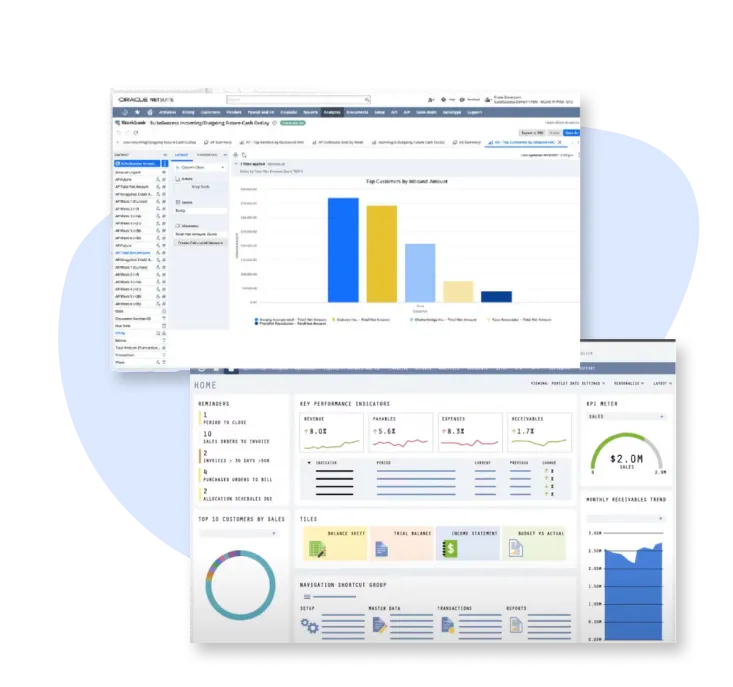

Advanced Revenue Recognition Compliance (ASC 606)

NetSuite provides built-in functionality for ASC 606 compliance, automating the complex process of revenue recognition based on the transfer of control. This ensures accurate financial reporting and reduces the risk of non-compliance, helping SaaS companies maintain regulatory standards.

Comprehensive Contract Management

NetSuite offers robust contract management tools that automate the tracking of contract terms, renewal dates, and amendments. This helps SaaS companies manage contracts efficiently, avoid missed renewals, and prevent revenue leakage, while maintaining accurate customer records.

Effective Upsell and Cross-Sell Management

With integrated CRM and sales automation features, NetSuite enables SaaS companies to track and manage upsell and cross-sell opportunities effectively. This helps maximize customer lifetime value by identifying and capitalizing on additional revenue streams within the existing customer base.

Realtime

Financials

NetSuite provides real-time financials, enabling immediate insight into your business's financial health and facilitating swift, data-driven decision-making.

Sophisticated Billing and Subscription Management

NetSuite supports complex billing requirements, including recurring billing, usage-based billing, and multi-tier pricing. Its automated billing processes reduce the risk of errors and inefficiencies, ensuring timely revenue collection and improving cash flow management. This helps SaaS companies handle their billing needs seamlessly and maintain financial stability.

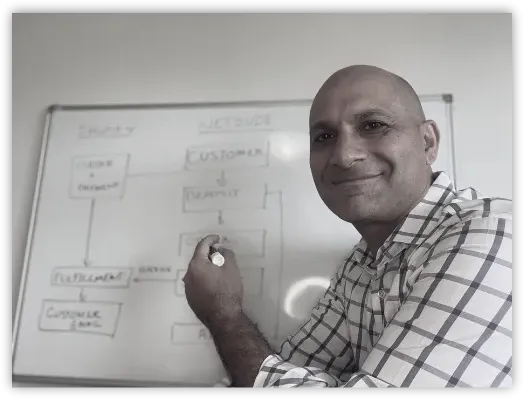

I Help Software SaaS Organizations Scale

Zabe Siddique is widely acknowledged for his expertise in Enterprise Resource Planning (ERP) systems with a career that spans over 25 years. Zabe's journey through the world of ERP is not just about his career milestones; it's a story of his genuine passion and consistent dedication to helping organizations transform their business with ERP.

“My expertise lies in partnering with companies to navigate the complex journey of business transformation through the strategic implementation of ERP solutions. I assist organizations in streamlining their processes, enhancing operational efficiency, and achieving a competitive edge in their respective industries.”

Zabe Siddique

CEBA Solutions CEO and Founder

Why CEBA Solutions

CEBA Solutions is a prominent NetSuite Solution Provider known for its expertise in delivering advanced NetSuite implementations for a diverse range of industries including saas.

At CEBA Solutions, we excel in customizing NetSuite implementations specifically for the saas industry. Our team understands the distinct challenges and needs of this sector, from complex supply chain management to stringent regulatory compliance. We delve deep into each client's specific requirements, leveraging NetSuite to craft a system as distinctive as their business.

Our commitment goes beyond system implementation; we aim to build lasting partnerships with our clients. We provide continuous support and enhancements well after the initial setup, ensuring that our clients' investments in NetSuite deliver ongoing value. What truly distinguishes us at CEBA Solutions is our dedication to adapting our solutions to the evolving needs of the saas industry, helping our clients thrive in a competitive landscape.

Our Client Review

"CEBA was the partner that we needed to implement NetSuite in a thoughtful and pragmatic way. We lost three months by not having a conversation with CEBA first"

Pat Piette - CFO, Sabbel Concepts

"I can explain a situation to Zabe and he knows exactly where we need to tackle that challenge and how to direct his team to ensure that we get there, and to make sure that the ultimate outcome is exactly what I'm looking for as a client. He does a really good job of that."

Steve Robertson - CFO, HDMI